unemployment federal tax refund 2020

For the 2020 tax year if you received EI payments and your net income was greater than 67750 the Canada. 2020 and 2019 tax years.

Recipients Of 2020 Unemployment Benefits May Be Eligible For Arizona Income Tax Refund Gilavalleycentral Net

Here is more information about unemployment.

. Today employers must pay federal unemployment tax on 6 of each employees eligible wages up to 7000 per employee. Will I receive a 10200 refund. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received.

Check The Refund Status Through Your Online Tax Account. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. Usually your business receives a tax credit of up to.

COVID Tax Tip -IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds. This law change occurred after some people filed their 2020 taxes. Information for people who already filed their 2020 tax return.

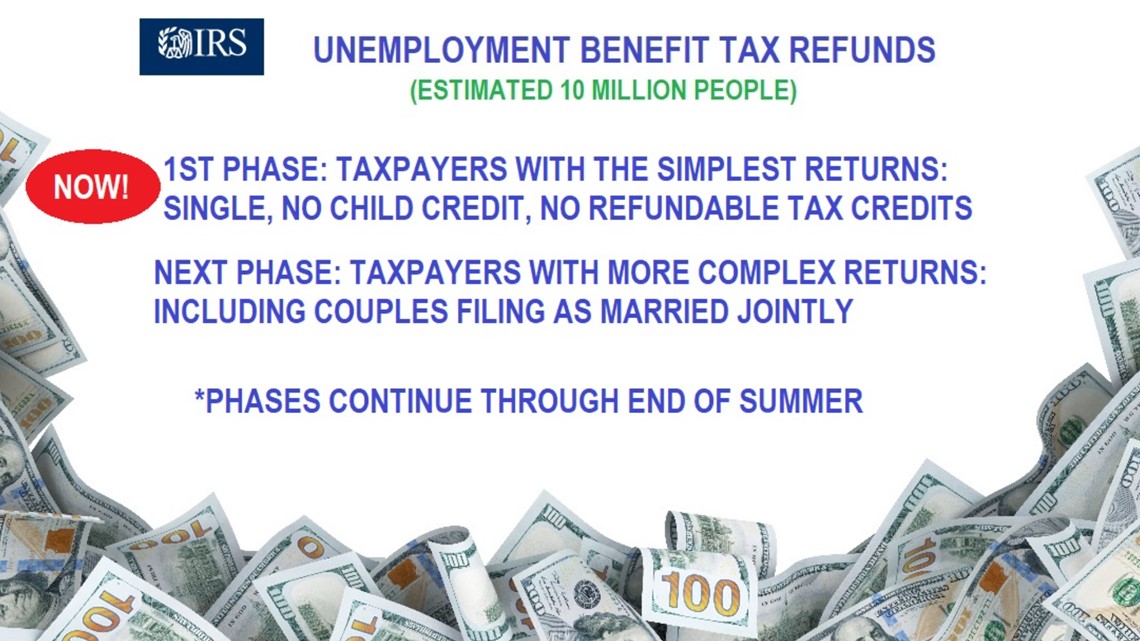

Tax Refunds on 2020. Single taxpayers who lost work in 2020 could see extra refund money soonest Susan Tompor Detroit Free Press May 14 2021 332 PM 4 min. File 2019 Tax Return.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. You would be refunded the income taxes you paid on 10200. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

Some taxpayers will receive refunds that will be issued periodically and some will have the overpayment applied to taxes due or other debts. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. The additional 600 per week.

Tax refunds on unemployment benefits to start in May. Whether or not a state tax refund is counted as income on a federal tax return depends on whether you took an. Or possibly lead to a bigger federal income tax.

Choose the federal tax. Dont expect a refund for unemployment benefits. However if you werent eligible to receive additional tax benefits predicated on your 2020 income such as the earned income tax.

Updated March 23 2022 A1. For some there will be no change. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in 2020 unemployment compensation from taxable income calculations.

The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only. Its taking us more than 21. 2021 tax preparation software.

The first phase of refunds will go to taxpayers who are eligible to exclude up to 10200 of unemployment benefits from their federal taxable income. There is no tool to track it but you can check your tax transcript with your online account through the IRS. Employers engaged in a trade or business who pay compensation.

The IRS has sent 87 million unemployment compensation refunds so far. How unemployment benefits can impact filing for 2021. 36 related questions found.

Unemployment compensation is intended to provide benefits to employees who lose their jobs through no fault of their own. File your federal taxes for free no matter how complex your return is. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of.

File 2017 Tax Return. For taxpayers who already have filed and. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

The federal tax code counts jobless. The IRS says eligible individuals shouldve received Form 1099-G from their state unemployment agency showing in. 22 2022 Published 742 am.

File 2020 Tax Return. Fort Lee NJ 07024 201 308-9520. Loans are offered in amounts of 250 500 750 1250 or 3500.

File 2018 Tax Return. In the case of married. The letters go out within 30 days of a correction.

COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable. Unemployment 10200 tax break. Employers Quarterly Federal Tax Return Form W-2.

By Anuradha Garg. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. Unemployment Federal Tax Break.

File For Unemployment In Arkansas In 2020 You Could Get A Refund Thv11 Com

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

The Irs Is Sending Out 4 Million Refunds Related To 2020 Unemployment

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

State Income Tax Returns And Unemployment Compensation

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Did You Get Unemployment In 2020 You Could See A Tax Refund Soon Wfmynews2 Com

Fox43 Finds Out How To Boost Your 2020 Tax Refund In Pa Fox43 Com

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

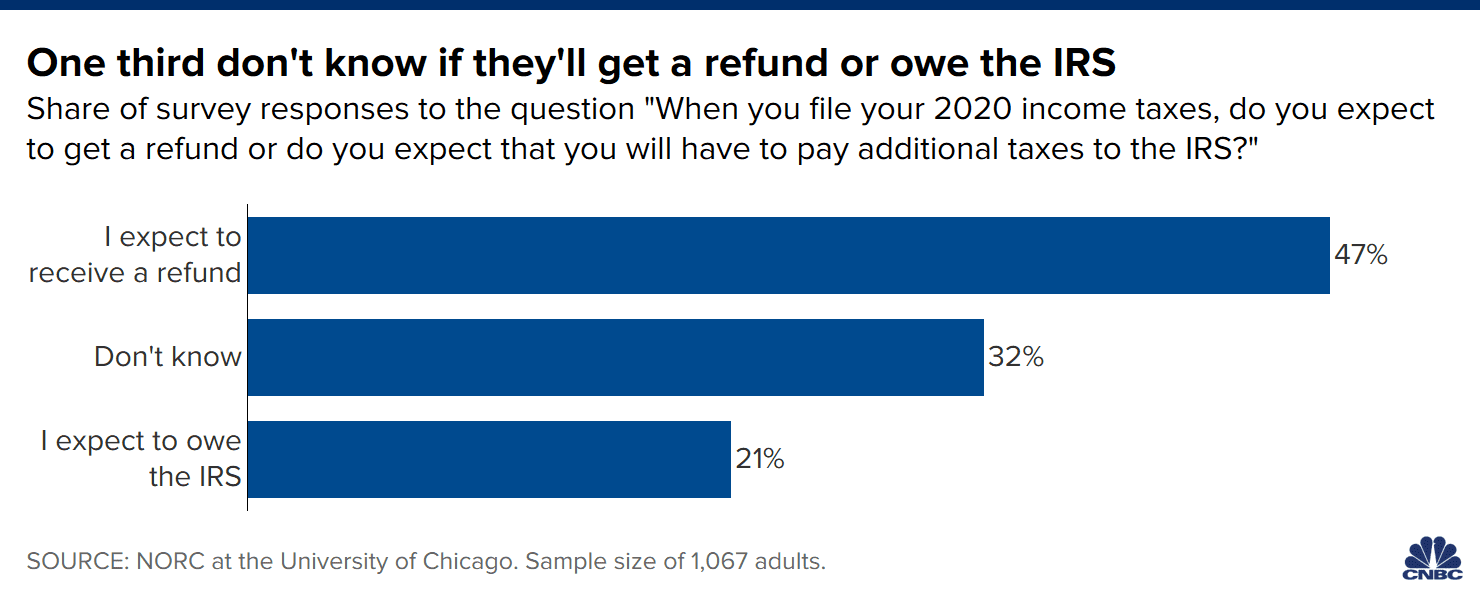

Will You Get A Tax Refund Or Owe The Irs 32 Of Americans Don T Know

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

If You Received Unemployment Benefits In 2020 A Tax Refund May Be On Its Way To You Youtube

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Interesting Update On The Unemployment Refund R Irs

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Unemployment Tax Break Hoh 3 Dependents Taxes Were Not Withheld During Unemployment Had This Date Of June 14th Pop Up On May 28th Then It Disappeared And Went Back To As Of